How To Use Travel Rewards Cards For The Most Points

May 23, 2016, Updated Sep 30, 2019

This post contains affiliate links. Please read our disclosure policy.

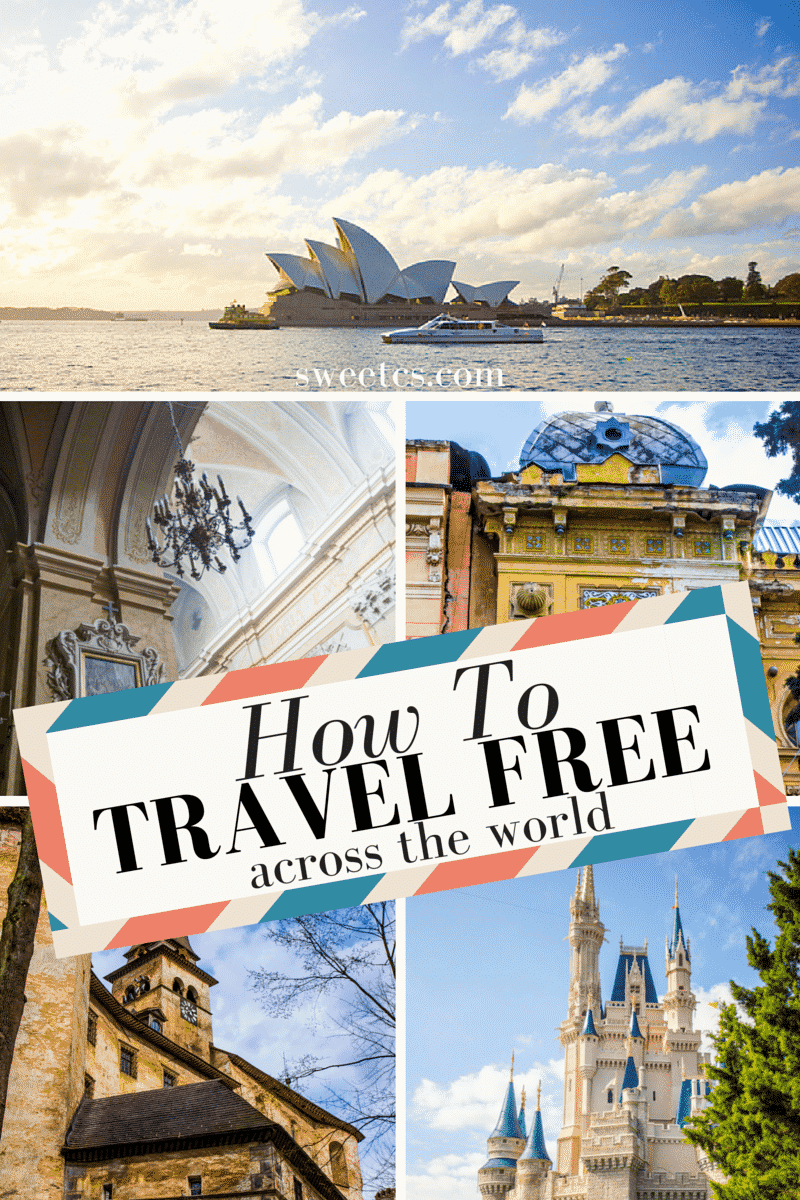

How to use travel rewards cards for the most points – a handy guide to start traveling free using airline points programs!

Want to start your path to traveling free, all over the world? You’re in the right place!

In this post of my How To Fly Free series, we’re going to talk all about How To Use Rewards Credit Cards to Get the Most Points.

My husband and I have recently figured out the secret to traveling free– even internationally- with our two kids in tow- totally free! It’s a simple method using the best airline and hotel points rewards credit cards- and we’ve done it all without spending a ton of money we wouldn’t regularly, or wrecking our credit. And we’re sharing our tips with you!

The more points you have, the faster you travel free! While most people think that means you have to spend tons of money (when a point is worth a dollar, 30,000 points to fly on a trip is $30,000 in spending- not really anything feasible for many families like mine!!!!), but that just isn’t true if you do it right.

First things first- these posts contain affiliate links.

While I do get a small payment when people signup though these links, this is the exact method I use and I believe in the products I’m linking to- your trust is worth more to me!

Also, using these links ensures you some of the best deals you will find.

There’s a lot of lower signup bonus cards out there, but I’ve found the best for you!

So, let’s get you traveling the world free!!!

Be sure to really dive in through my posts in this series (it helps to go in order and start at the beginning, but isn’t necessary):

-How To Find the Right Travel Rewards Card

-How to Use Rewards Cards for the Most Points

-How to Use Rewards Points to Fly Free

-How to Get Even More Rweards Points

-How to Keep Your Good Credit When Opening Cards

-Find the Best Credit Card to Travel With

How To Use Travel Rewards Cards For The Most Points

-Open cards around normal spending cycles. Don’t sign up for cards willy nilly just to increase spending and get into debt so you can hit your minimum for the signup bonus.

Plan opening a new card when you have a big expense coming up – if you know you’ll be buying a new computer, camera, school clothes, etc. – I’d open the card then.

Most cards have minimum spending of $2,000-$5,000 in the first three months to get the signup bonus (worth about $40,000-$80,000 in spending, depending on your spending habits and the card’s reward structure), which is the fastest way to travel free. View additional travel airline credit card offers here to find the best rewards for you!

-Pay off Balances or Keep Them Low. Traveling free can provide a BIG allure. It is too good a deal to get a free flight (especially a flight overseas!), but you’re not really getting something free if you’re spending outside your means, or carrying big balances and just paying for a ton of interest.

That isn’t saving you money or getting you a free flight- that is just getting you a way, way more expensive flight over time that just *looks* free up front.

–Don’t EVER open and close cards quickly! To get the best cards with the best rewards, you need good credit. It is NEVER a good idea to open and close accounts- it will completely wreck your credit report. I constantly check my credit report (seriously- I check it daily for new information) to be sure I am not opening new cards too quickly or if anybody is using my identity to open new accounts.

Don’t open a card if you won’t use it- it does not look good to have accounts close on your credit report- it’s ok if spaced out over time, but if you won’t use a card (which the bank will then close for inactivity), or you plan on closing it- just don’t add it.

Not only those reasons, but keeping a credit card open for a long time (which means using it, even if occasionally) really helps your credit. Credit bureaus reward long-standing credit – so the older an account in good standing is open, the better.

Don’t know your credit profile? Find out here and be empowered to get the absolute best rates.

-Pay attention to point structures. Some cards pay you double points for groceries and gas, some airline or travel (which on the Chase Sapphire card, my favorite, can even be so loosely interpreted as Uber trips!), and some computer equipment, etc.

Check into the point payout structure before signing up- make sure you really will take advantage of the card’s double point and sometimes triple point structure!

I like to keep an index card in my wallet with info on which cards get me better rates- I have notes reminding me which card to use for double points on travel, food, gas, or dining- and which to use for triple points on computer equipment, and which I just get standard points on.

If one card offers a higher reward for a certain purchase, you should use that one and be sure to always maximize points when you’re already spending!

I know I keep talking about the Chase cards, but I love them so much because they also are really handy for viewing your account balances and spending all in one, so I don’t have to track things all over the place. I love that I have numerous cards in one handy dashboard- and I love their travel booking! View Additional Airline & Frequent Flyer Credit Card Offers Here to find the right fit for you.

-Pay Attention to Loyalty Programs. When spending on airline or travel purchases, be sure you’re using a card that pays you well!

When I am flying United, I am sure to use my Chase United Rewards card, so I can get 2x points with any purchases– but that wouldn’t make sense with another airline. For those charges, I will use a more flexible rewards card like my Chase Sapphire so I can be sure to get those double rewards. View additional travel airline credit card offers here to get started!

-Maximize your trip with Hotel and other Points Cards.

A free flight is just one perk you can get- don’t forget to look into hotel card offers for free stays, which can really help cut costs on a trip!

Sometimes you can also book through your credit card’s site for the absolute best deals! View Additional Hotel Credit Card offers here!

Be sure to really dive in through my posts in this series (it helps to go in order and start at the beginning, but isn’t necessary):

-How To Find the Right Travel Rewards Card

-How to Use Rewards Cards for the Most Points

Next up: How to Use Rewards Points to Fly Free

-How to Get Even More Rweards Points

-How to Keep Your Good Credit When Opening Cards

-Find the Best Credit Card to Travel With

Good info thanks for the links as well